- Upstream Ag Insights

- Posts

- 2026 Ag Equipment Dealer Business Outlook & Trends Report Highlights and Analysis

2026 Ag Equipment Dealer Business Outlook & Trends Report Highlights and Analysis

Key insights on dealer inventory, profitability, and the shifting focuses for 2026.

Index

Overview

Equipment Market Outlook

New and Used Equipment Decline

Inventory Pressures

Price Increases

Profitability

Pre Sales/Early Order

The Aftermarket Emphasis

Revenue Growth

Margin Improvements

Absorption Rate

Top Industry Concerns

"Best Bets" for Sales Growth

Dealerships vs. Ag Retailers in Precision Ag

Workforce and Investment Plans

Hiring

Capital Expenditures

Dealer Optimism

Other Interesting Charts

Total Size by Dealer Type

Used Tractor Pricing Trends

1. Overview

The 2026 Dealer Business Outlook & Trends report by Ag Equipment Intelligence is a forecast based on surveys of North American farm equipment dealers.

The insights include projected revenue, profitability, and industry challenges for the coming year.

The report suggests that dealers anticipate 2026 to be another difficult year due to declining new equipment sales and profitability challenges stemming from high equipment costs and low commodity prices.

If you are interested in the full report, check out Ag Equipment Intelligence.

2. Equipment Market Outlook

New and Used Equipment Decline

The market for machinery remains tough.

Over 66% of dealers reported their 2025 new equipment revenue was down compared to 2024, with 55% reporting down on used equipment.

Only ~18% expected growth in 2025 in New Equipment and ~25% in used.

Looking ahead to 2026, a significant percnetage of U.S. dealers forecast a further decline of 2% or more.

Inventory Pressures

Inventory management remains a struggle. A net 42% of dealers reported their new equipment inventory levels were "too high.”

27% said their used equipment inventory was too high.

This is percent of dealers reporting inventory as “too high,” not dollars or percentage of sales.

If Titan Machinery is a bellwether, then it looks like inventory levels are starting to come down, in the Titan Machinery instance, by around 30%.

Price Increases

Inflationary pressure persists. Nearly all dealers (98.6%) expect price increases from manufacturers in 2026, with the majority anticipating a hike between 1% and 6%.

Profitability

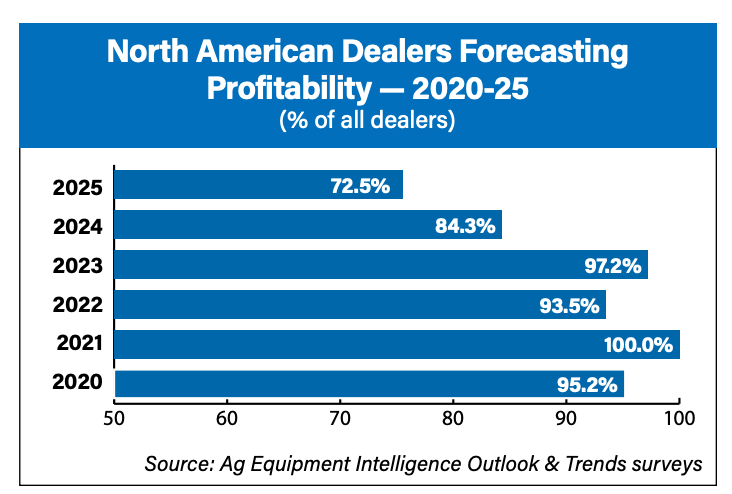

Only 72.5% were forecasting profitability in 2025, the lowest over the last 5 years by a significant margin:

Pre-Sales/Early Order

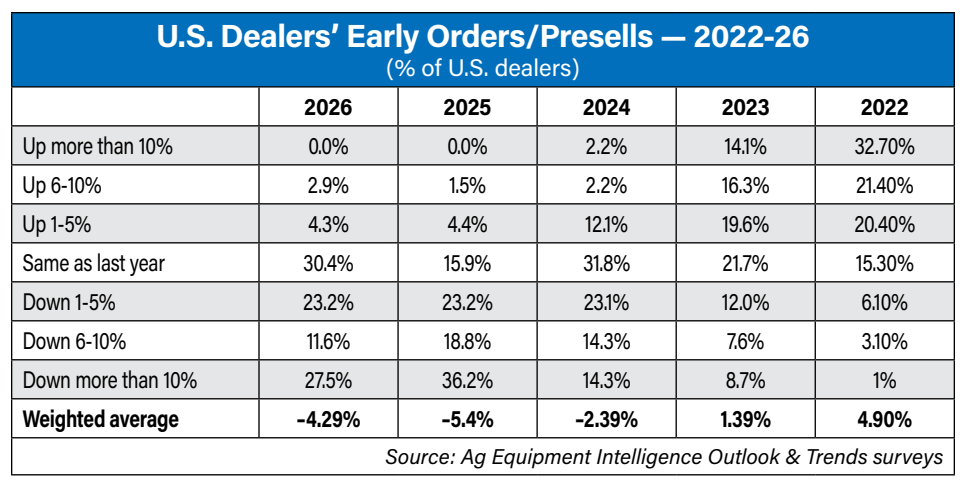

Across brands, early-order trends for 2026 improved versus last year but remain negative overall, with John Deere the lone exception showing the lowest weighted average decline:

Kubota dealers posted the least negative results, with a weighted average of –1.8%. Most Kubota dealers (71.4%) reported flat early orders, and while fewer dealers saw declines than last year, none reported increases for 2026.

AGCO dealers improved meaningfully year over year, with the weighted average improving to –4.0% from –8.0% in 2025. A small share (5.6%) reported increases, but roughly two-thirds still saw declines, mostly in the 1–5% range.

Case IH and John Deere dealers reported more pressure. While over 13% of Case IH dealers saw increases, more than 72% reported lower early orders, with nearly one-third down 10% or more. John Deere showed the greatest downside skew, with 50% of dealers reporting early orders down more than 10%, despite 16.6% reporting modest increases and 25% reporting flat orders.

New Holland dealers were the weakest overall, with no reported increases, nearly 30% flat, and more than 70% reporting declines, including over one-third down more than 10%.

3. The Aftermarket Emphasis

Revenue Growth

Subscribe to Upstream Ag Professional to read the rest.

Become a paying member of Upstream Ag to get access to this post and other subscriber-only content.

Already a paying subscriber? Sign In.

A Professional Membership Delivers:

- • Subscriber-only insights and deep analysis plus full archive access

- • Audio edition for consumption flexibility

- • AskUpstream Access, the LLM for serious agribusiness professionals

- • Access to the Report Hub and Visualization Hub