- Upstream Ag Insights

- Posts

- Pivot Bio Investor Day Highlights and Analysis

Pivot Bio Investor Day Highlights and Analysis

Index

Introduction

Pivot Bio Background

Tyranny of the Or vs. The Genius of the And: Fertilizer Sources

Distribution

Priority Customers

Digital Initiatives

Platform for Crop Nutrition

On Seed

Final Thoughts

Key Takeaways

Pivot Bio aims for $1 billion in revenue by 2030, targeting new product launches, regional expansion, evolution beyond Nitrogen fixing microbes towards nutrients, soil amendments and other microbes, along with expanding it’s route to market through retail.

Pivot Bio announced a "white glove" service tailored towards end-to-end support for large-scale corn farmers, building deeper customer relationships and driving long-term loyalty with the brand.

Launching Agronomy Co-Pilot, a digital tool, to support crop nutrition decisions.

Pivot Bio is exploring partnerships with major seed companies.

Pivot Bio’s products have been used on 15 million acres.

Pivot Bio is focusing on top-performing resellers and expanding retail distribution to over 500 locations, enabling broader market access and faster growth.

Introduction

This week, I had the opportunity to attend Pivot Bio’s inaugural Investor Day, held in Minneapolis.

The event brought together a diverse group of stakeholders—from distributors, to investors, and ag industry leaders. The breadth of attendees reflected Pivot’s growing relevance across the agricultural value chain and the company’s intent to build trust and transparency with all parts of the industry.

The purpose of the day was clear: showcase the foundation Pivot Bio has built and offer a forward-looking perspective on where they’re headed.

With aspirations to surpass $1 billion in annual revenue by 2030, Pivot is positioning itself not only as a nitrogen alternative provider, but as a leading company in crop nutrition.

From product innovation and manufacturing infrastructure to commercial strategy and agronomic support, the event served as a roadmap for how Pivot intends to scale impact and drive adoption in the years ahead.

Pivot Background

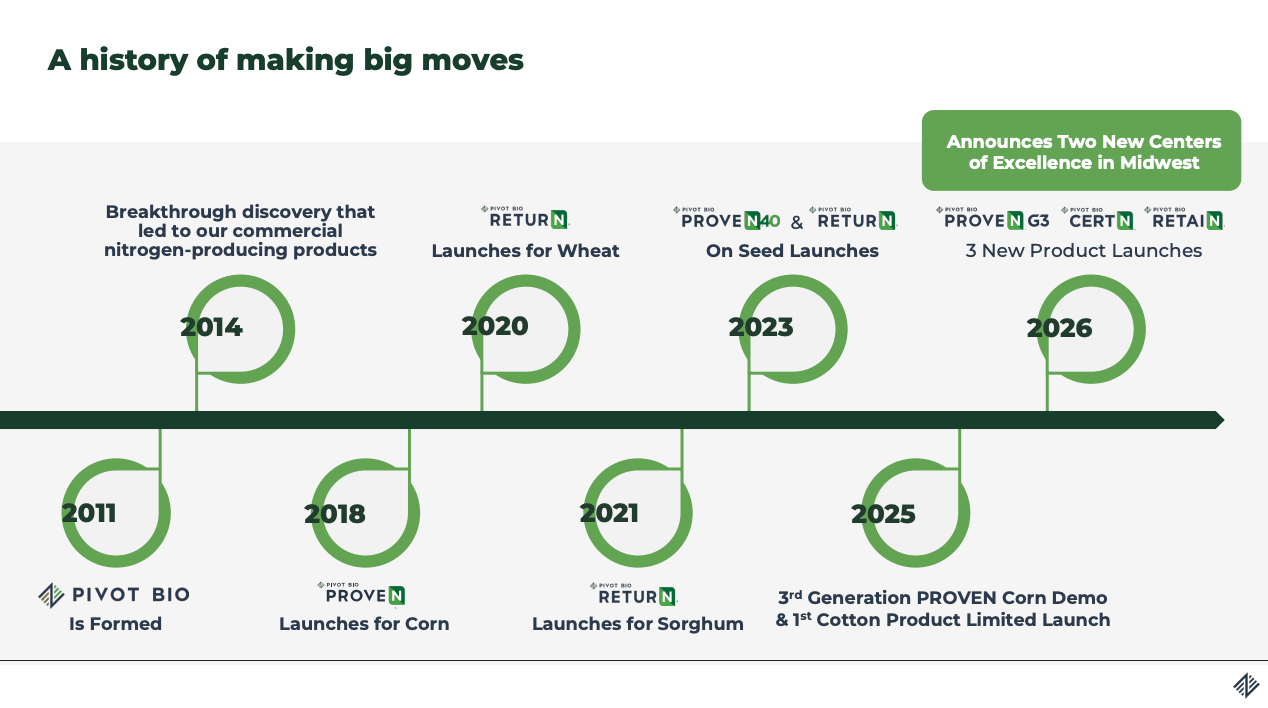

Founded in 2011 by Karsten Temme and Alvin Tamsir, Pivot Bio emerged with a bold vision to genetically engineer soil microbes to fix nitrogen for non-pulse crops— the holy grail of fertilizer.

By 2018, they commercialized PROVEN®, becoming the first to bring nitrogen-fixing microbes to U.S. corn farmers, with wheat and sorghum launching in 2020 and 2021 respectively.

By 2022, Pivot surpassed $50 million in revenue and had products on over 3 million acres plus announcing an on-seed product.

In 2023, they stated that they had surpassed $100 million in annual revenue.

In late 2024 they announced the expansion of geography to Brazil and expanded their route to market to include retailers.

This week, they announced a shift beyond just microbes and nitrogen.

Tyranny of the Or vs. The Genius of the And: Fertilizer Sources

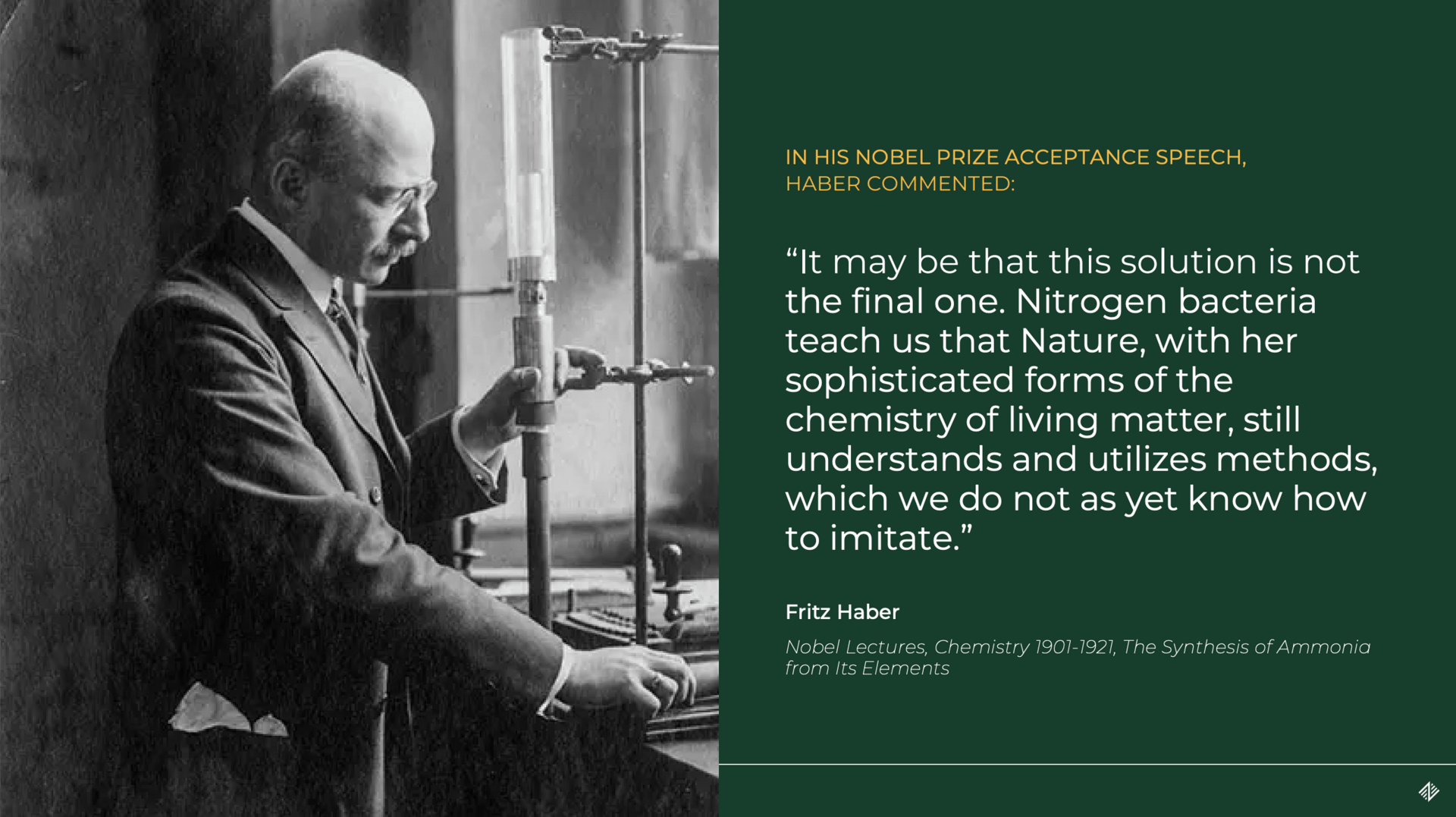

In his presentation, Pivot Bio CEO Chris Abbott highlighted a quote from Fritz Haber, the scientist behind the “Haber” portion of the Haber-Bosch process, that was shared by Haber during his Nobel lectures:

For well over 100 years there has been acknowledgment of the potential of microbes for delivering nitrogen to crops.

But I don’t believe, and Pivot Bio doesn’t seem to suggest, that they are shutting the lights off on the Haber-Bosch process. It is very much an “and” approach.

In the book Built to Last, Jim Collins shared a frameworks for how great companies think, known as the “Genius of the AND” vs. the “Tyranny of the OR.”

In the book, he talks about the “Tyranny of the OR” forcing false choices that leave gaps or don’t enable a company to be “great,” meaning companies think to themselves “we can do this or that, but not both.”

According to Collins, great companies reject the premise of “or.” They embrace the “Genius of the AND,” meaning they find ways to do two things simultaneously that other companies would otherwise not do.

The same principle applies to farmers and nitrogen sources— there is no need to rely on the current two sources of nitrogen. There is an ability to add a third nitrogen source on top of synthetic (eg: urea, NH3 etc) and organic (mineralized, manure etc) sources, coming from microbial fixation.

That “third source” is can be beneficial to farmers for a several reasons:

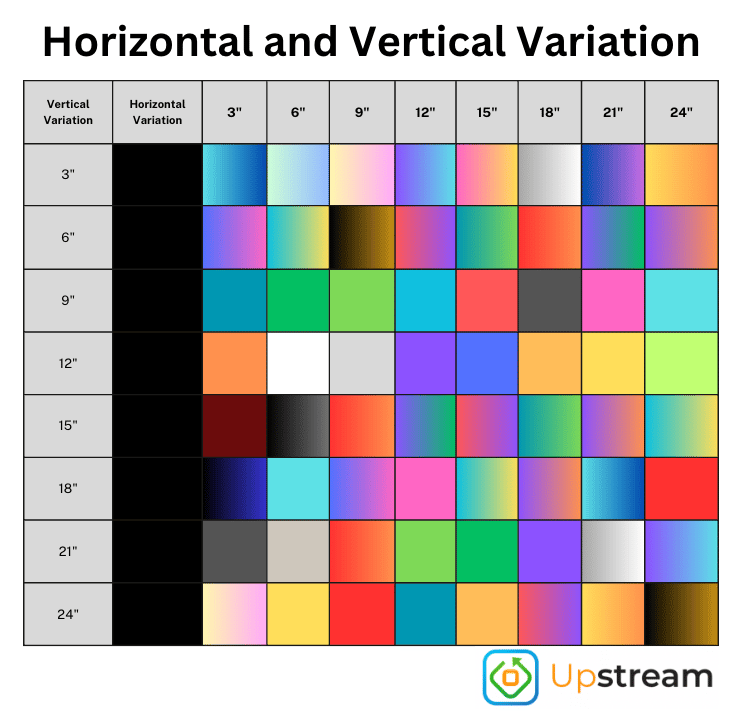

Dr. Fred Below, a farmer and researcher from the University of Illinois and panelist at the event, shared his view that due to soil variation, there is always going to be areas of the field that will need access to ancillary nitrogen throughout the crops life cycle. I have attempted to illustrate the complexity of soil variability using the below image, with each box suggesting a unique amount of available N (and every other nutrient) across the horizontal and vertical variation of the soil:

Having microbes associate directly with the plant can deliver a constant source of nitrogen to the plant that isn’t as prone to the variability of the soil and factors causing N to leach, or volatilize etc.

Synthetic nitrogen is a commodity prone to price fluctuations from geopolitical, weather induced or global demand variability every day of the year, leaving costs subject to considerable swings. Plus Pivot shares that in averaging 38lbs of N per acre delivered to the crop, at a price of ~$19/ac means one of the least expensive sources of N on the market on a per pound basis.

Nitrogen fertilizer is bulky and reducing synthetic N needs can improve operational efficiency of any given farm. On a 2000ac farm seeded to all corn, removing 40 actual pounds of N equates to almost 80 metric tonnes (~170,000lbs) of nitrogen that doesn’t need to be stored or applied.

Environmental and microbial impact being mitigated.

There remains opportunity for Pivot Bio, but for a company that has raised more than $600 million, and last raised at a valuation north of $1 billion, how do they grow into that valuation and create a sustainably growing business?

Pivot Bio shared several initiatives that are targeted at enabling them to grow to $1 billion in revenue by 2030.

Distribution

Pivot Bio began it’s commercial efforts by selling outside the traditional channel— opting for selling through traditional seed dealers or identifying Pivot Bio approved resellers themselves.

Since the early days of Upstream, I had been skeptical of it as a stand alone approach, speculating they would adjust to a multi-channel approach:

My bet is they adjust this direct to farmer model in the short term to medium term to a hybrid.

Building out a direct to farmer model is slow and arduous.

It can be an incredible go-to-market— the two most respected brands in North American agriculture (John Deere and Pioneer) have effectively owned their route to market in a way that Pivot Bio aspired towards.

However, building it out steadily over decades is very different than building with venture capital timelines (and different economics on equipment and seed vs. a microbial product).

And when you need faster growth, you bring on more resellers that aren’t always “in it,” which can hinder brand and growth.

During the event Pivot Bio shared that they have more than 700 direct resellers of Pivot products, however, they have been pulling away from the lowest performing group with the top 200 dealers making up over 80% of total sales growth in 2025, giving them the ability to allocate more resources and training to the most engaged and high performing groups.

Pivot Bio doesn’t publicly state their annualized acres anymore, however, they state total acres their products have been used on since commercialization as 15 million through the rep network.

Subscribe to Upstream Ag Professional to read the rest.

Become a paying member of Upstream Ag to get access to this post and other subscriber-only content.

Already a paying subscriber? Sign In.

A professional subscription gets you:

- • Subscriber-only insights and deep analysis plus full archive access

- • Audio edition for consumption flexibility

- • Access to industry reports, the Visualization Hub and search functionality