- Upstream Ag Insights

- Posts

- Q2 2025 Agribusiness Earnings Summary: BASF, FMC, UPL, AGCO, CNH & TELUS

Q2 2025 Agribusiness Earnings Summary: BASF, FMC, UPL, AGCO, CNH & TELUS

Highlights and analysis of influential agribusinesses Q2 2025.

Agribusiness Earnings Results Highlights and Analysis

Index

BASF

FMC

UPL

AGCO

CNH Industrial

TELUS Agriculture and Consumer Goods

About Upstream Ag Professional Agribusiness Breakdowns

Each quarter in Upstream Ag Professional, I analyze publicly traded agribusiness results to highlight the key takeaways that matter for those of us working in the agriculture industry.

By breaking down earnings results and executive commentary, I provide the strategic insights agribusiness professionals need to stay ahead of their competitors, their suppliers and ultimately their customers.

The below is just one portion— more deep dives on the most influential agribusinesses, their market positioning, and strategic initiatives will be published as results become available.

If you want to satiate your curiosity and be the best-informed in the industry, you’re in the right place.

Other Related Breakdowns:

Q1 2025 Ag Equipment Manufacturer Results Highlights and Analysis - Upstream Ag Professional

Q1 2025 Crop Protection & Seed Company Results: Themes, Highlights and Analysis - Upstream Ag Professional

Q1 2025 Fertilizer Manufacturers Results Highlights and Analysis - Upstream Ag Professional

FY 2024 Ag Equipment Manufacturer Earnings Highlights and Analysis - Upstream Ag Professional

FY 2024 Crop Protection & Seed Company Results: A Deep Dive into Themes, Highlights and Analysis - Upstream Ag Professional

FY 2024 Fertilizer Company Highlights and Analysis - Upstream Ag Professional

Access the financials I have compiled to be able to effectively look at major agribusinesses in detail here: Agribusiness Financial Data Q4 2022 to Q4 2024 (Excel Workbooks)

1. BASF Q2 2025 Results - BASF

Q2 Results

Revenue grew by 13.5% to €2,198 million, compared to €1,937 million in Q2 2024. The increase was primarily due to higher volumes in North America and Europe.

EBITDA Before Special Items saw a considerable increase to €417 million, up from €135 million in Q2 2024. This was driven by higher volumes and improved contribution margins in the herbicide and fungicide businesses.

EBITDA Margin Before Special Items was 19.0%, which is considerably higher than the 6.9% recorded in Q2 2024.

H1 Results

Revenue - €5,401 million, which was nearly at the same level as the prior-year period. This was due to volume growth largely offsetting negative currency and price effects.

EBITDA Before Special Items - Increased by 8.4% to €1,621 million from €1,496 million in H1 2024. The improvement was mainly driven by increased volumes.

EBITDA Margin Before Special Items - Rose to 30.0% from 27.6% in the first half of 2024

Volumes rose in all segments except for seed treatment. The absolute volume increase was most pronounced in herbicides. Executives expect Agricultural Solutions to grow in FY 2025.

ERP Changes

As part of the 2027 Agriculture Solutions spin out, BASF is currently focusing on ERP separation.

I can imagine this is a distraction for BASF— Lamb Weston, as one example, had immense challenges when going through ERP changes causing significant issues for their entire business long term.

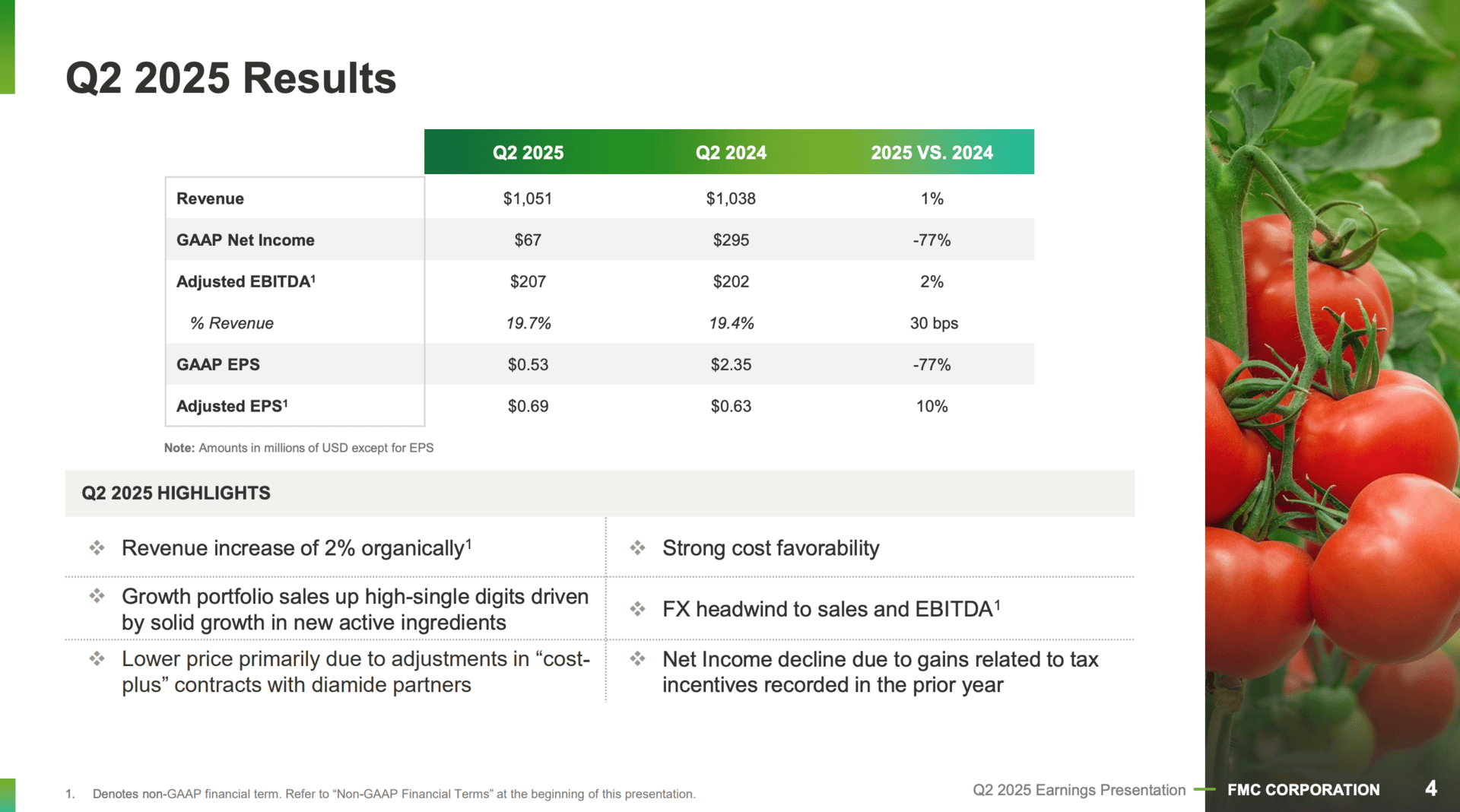

2. FMC Q2 2025 Results - FMC

Subscribe to Upstream Ag Professional to read the rest.

Become a paying member of Upstream Ag to get access to this post and other subscriber-only content.

Already a paying subscriber? Sign In.

A professional subscription gets you:

- • Subscriber-only insights and deep analysis plus full archive access

- • Audio edition for consumption flexibility

- • Access to industry reports, the Visualization Hub and search functionality