- Upstream Ag Insights

- Posts

- Q3 2025 Agribusiness Earnings Results Highlights and Analysis

Q3 2025 Agribusiness Earnings Results Highlights and Analysis

ADAMA, BASF, FMC, Syngenta, AGCO & Helena/Marubeni

Index

ADAMA

BASF

FMC

Syngenta

AGCO

Helena/Marubeni

1. ADAMA Q3 2025 Results - ADAMA

ADAMA had flat Q3 revenue of $933 million, with a 1% increase in volume offset by a 1% decline in prices.

Gross margin rose to 27.6% from 24.2% due to lower costs and operational efficiencies.

Adjusted EBITDA climbed 50% to $120 million, lifting margin to 12.9% from 8.6%.

Their business was strong in most regions in Q3 except Asia Pacific:

Company commentary on LatAm was the most notable:

In Brazil, revenues were significantly up in the third quarter, resulting in higher revenues also for the first nine months compared to the previous year. Growth was driven by increased volumes, while the third quarter also experienced modest pricing increases. In the rest of LATAM lower volumes, prices, and revenues were reported in the third quarter and the first nine months, primarily in Paraguay and Argentina, due to channel destocking and just-in-time purchasing behavior.

Company Market Commentary:

Through the first nine months of 2025, channel inventory returned to pre-pandemic levels in most countries, allowing crop protection demand recovery. Pricing pressure remains high, driven by production over-capacity of active ingredients. Crop commodity prices remain stably low and coupled with the high-interest rate environment, farmer profitability remains tight leading to just-in-time purchasing patterns.

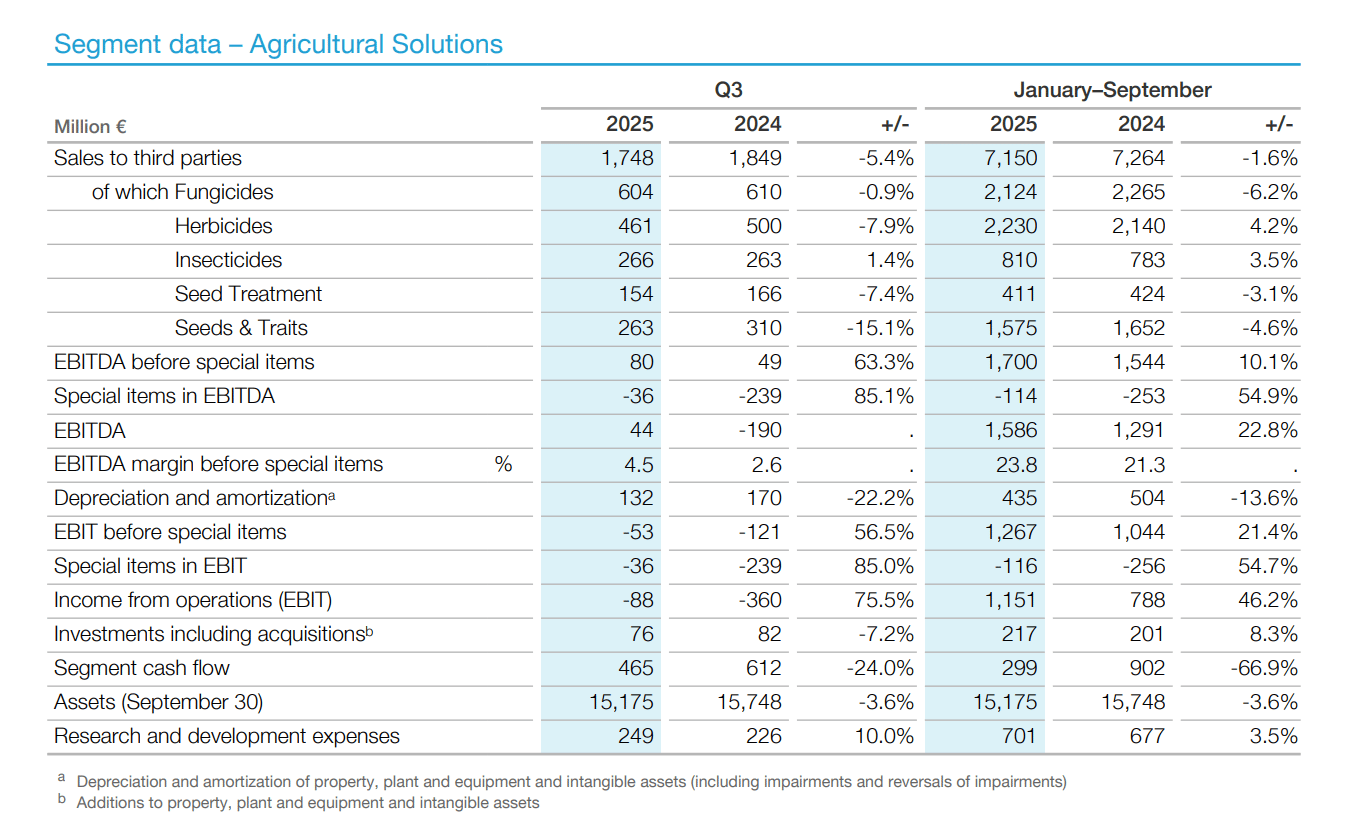

2. BASF Q3 2025 - BASF

Europe remained under pressure. Early-season purchasing, a weak Turkish market, and adverse weather led to materially lower volumes. Ongoing price erosion erased any currency benefit.

North America followed a similar pattern. Demand softened, price pressure persisted, and the strong U.S. dollar further weighed on performance. Growth in glufosinate helped, but not enough to offset the broader market weakness.

South America, Africa, and the Middle East were the exception. Higher volumes and firmer pricing supported growth, though a weaker Brazilian real tempered the upside.

Lower manufacturing costs and stronger margins from glufosinate lifted EBITDA margin expansion from 2.6% to 4.5%.

The main negative was cash flow. Inventory builds reversed last year’s drawdown, offsetting much of the EBITDA improvement and tightening liquidity.

Executive Commentary:

On the other hand side, I would say we have a healthy channel inventory. So demand substantially we see for our products. This is also why we are optimistic for the rest of the year that the Ag Solutions segment will deliver on its plans. Going forward, we see the business really in a competitive shape because we have last year taken a lot of measures, the restructuring of the glufosinate ammonium, which is now paying off and other efficiency measures taken in the division, which really give us a good competitive position. So I would say, despite the low price levels that we currently still see in the business, we feel good about the business also going into the next year. But certainly, it will be helpful at one point in time if the soft commodity cycle is then gaining momentum to the upside again. So with regards to the partial IPO, we are saying it's a partial IPO because we have no intention to launch 100% of the shares at the inception. We use the term partial IPO to show and to say that this business also beyond the IPO event will be a business that is consolidated into our group financials, and it's a business that we also like. We have not set any definitive portion of shares that we are going to launch on IPO at this point in time. We will do so at the right moment in time. And then what happens over time remains to be seen. But clearly, at inception, it will be a partial IPO, and this is what we are clearly saying.

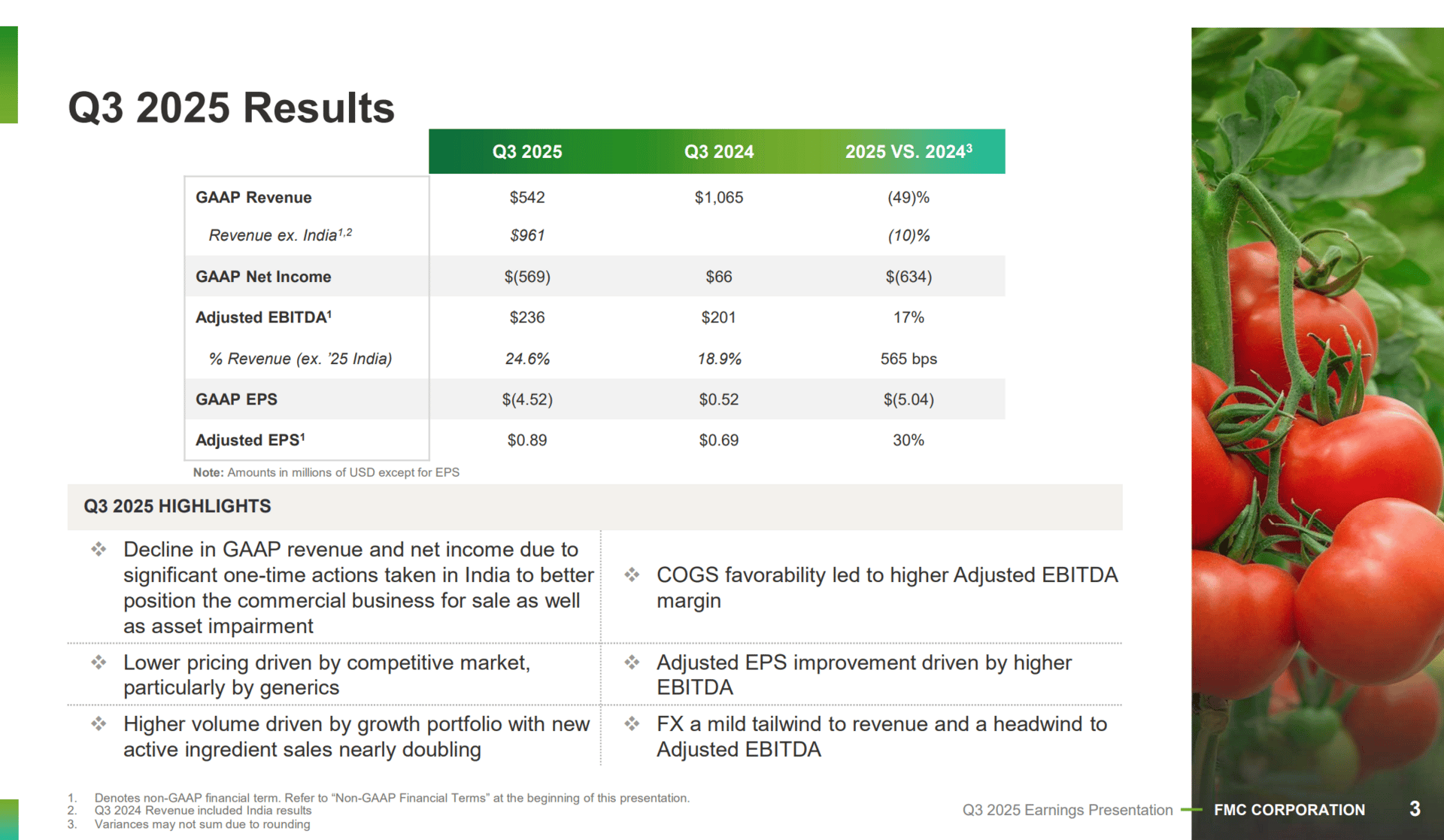

3. FMC Corporation Q3 Results - FMC

$2 Billion in Value Destruction

Subscribe to Upstream Ag Professional to read the rest.

Become a paying member of Upstream Ag to get access to this post and other subscriber-only content.

Already a paying subscriber? Sign In.

A professional subscription gets you:

- • Subscriber-only insights and deep analysis plus full archive access

- • Audio edition for consumption flexibility

- • Access to industry reports, the Visualization Hub and search functionality