- Upstream Ag Insights

- Posts

- Q3 2025 Fertilizer Manufacturers Results Highlights and Analysis

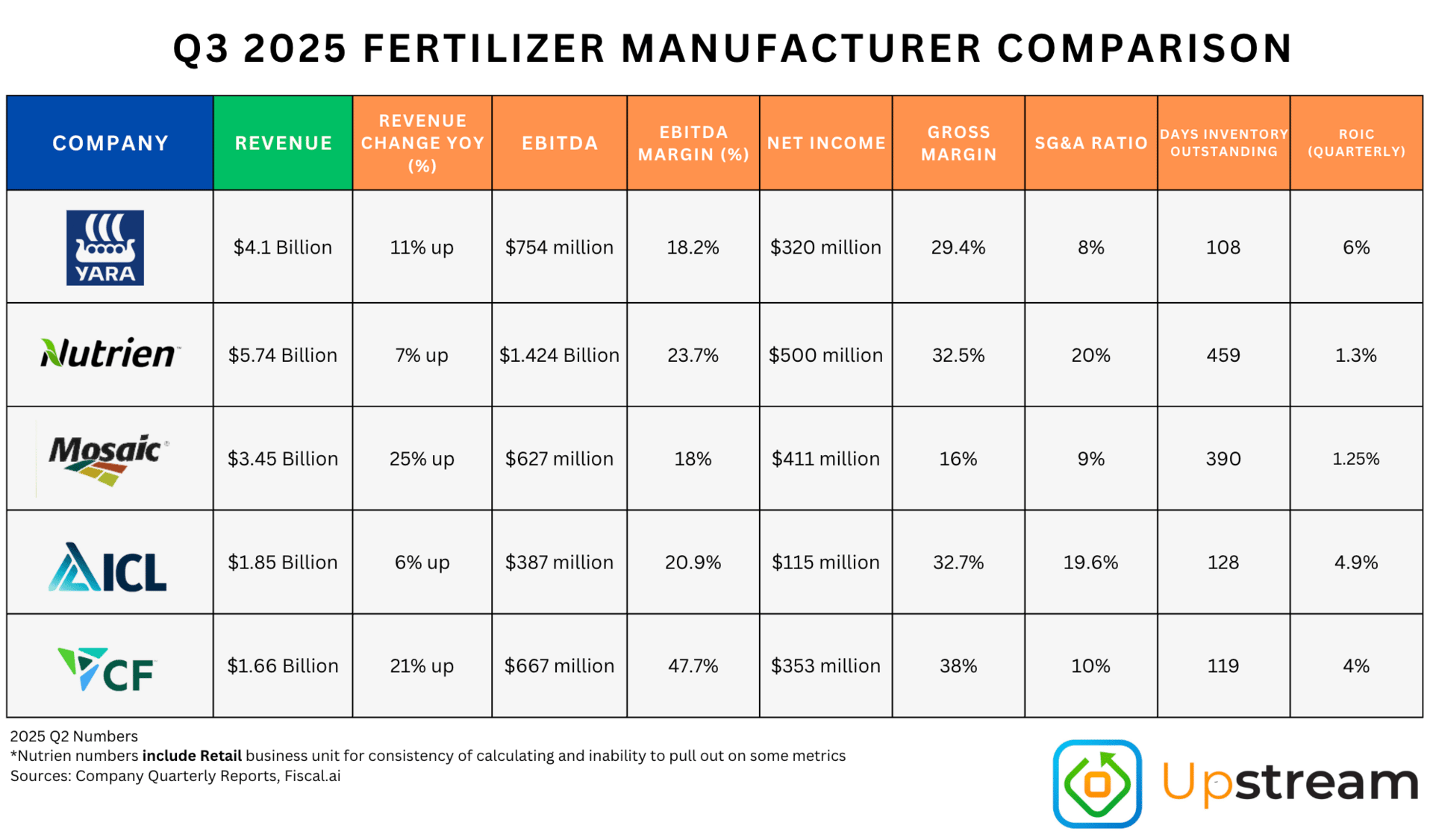

Q3 2025 Fertilizer Manufacturers Results Highlights and Analysis

Nutrien, Mosaic, CF Industries, ICL, Yara

Index

Financial Overview

Themes

Nutrien

Mosaic

CF Industries

ICL

Yara

Financial Charting: Company Comparisons

Revenue

EBITDA

EBITDA Margin

Gross Margin

SG&A Ratio

ROIC

About Upstream Ag Professional Agribusiness Breakdowns

Each quarter in Upstream Ag Professional, we analyze publicly traded agribusiness results to highlight the key takeaways that matter for those of us working in the agriculture industry — that means looking at the intersection of financials with product details, competitive dynamics, executive commentar, external factors and strategic considerations that are often missing in the financial results.

By breaking down earnings results and executive commentary, we provide insights agribusiness professionals need to stay ahead of their competitors, their suppliers and ultimately their customers.

Financial Overview

Themes and Highlights

1. Potash is Stable, Tight, and Pushing Toward Another Record Year

Across Nutrien, ICL, and Mosaic, potash is the most “structurally sound” nutrient market heading into 2026 from a global perspective.

Nutrien expects global potash shipments of 74–77 million tonnes in 2026, marking a fourth year of demand growth, driven by strong affordability and high nutrient removal from large global crop production.

One quote to reinforce this view came from Nutrien CEO Ken Seitz on China surrounding Potash:

“In China, reported port inventories are down by more than 1 million tonnes year-over-year. In addition, we anticipate limited new global capacity additions in 2026 with announced project delays and remain constructive on supply and demand fundamentals.”

Mosaic said that strong demand in Southeast Asia (up to 50% higher in some markets) and record Canpotex shipments are expected into 2026, too.

Both Nutrien and Mosaic explicitly point to limited new global capacity, and Laos supply remains uncertain.

2. Nitrogen is Tight in Supply and Decarbonization Emphasis Seemingly Coming to Fruition

Nutrien reports a 94% ammonia utilization rate and emphasized a tight global ammonia balance driven by outages and project delays, with seasonal urea demand adding further lift.

Trinidad disruptions remove marginal supply from the market, with Nutrien suspending operations amid gas and port uncertainty.

Yara numbers (which are heavily Europe influenced, but still applicable) suggest the optimal rate for Nitrogen based on ROI in wheat has declined by 5% year over year:

Subscribe to Upstream Ag Professional to read the rest.

Become a paying member of Upstream Ag to get access to this post and other subscriber-only content.

Already a paying subscriber? Sign In.

A Professional Membership Delivers:

- • Subscriber-only insights and deep analysis plus full archive access

- • Audio edition for consumption flexibility

- • AskUpstream Access, the LLM for serious agribusiness professionals

- • Access to the Report Hub and Visualization Hub