- Upstream Ag Insights

- Posts

- Upstream Ag Professional - July 13th 2025

Upstream Ag Professional - July 13th 2025

Essential news and analysis for agribusiness leaders.

Welcome to the 101st Edition of Upstream Ag Professional!

Index:

New PDF and Reading Lists Available

Inside Miraterra’s Bet on Soil Intelligence

Lavie Bio Sale to ICL Closes

Strategy First, AI Second

Control the Narrative, Own the Outcome: What Agribusiness Professionals Can Learn from Chuck Magro, David Friedberg and John Deere

From Ocean to Farm: Acadian Plant Health’s Seaweed Extract-based Biostimulants Innovation + Bio-Based Molecule Extraction

The realities of agrifoodtech investment in 2025: ‘Venture capital is not about being patient’

Nerd Out on Business

Other Interesting Ag Content (11 this week)

This week marks two-years since the launch of Upstream Ag Professional.

Whether you’ve been here since the beginning or recently joined, thank you. Your time, attention, and trust mean more than I can express. I’m grateful that you choose to be a Professional member, read, and share each week— your support is what makes all of this possible.

Looking to the second half of 2025, I’m working on several initiatives designed to make Upstream more useful and engaging, including:

Interactive Intelligence Hub — A completely new interface for exploring the Upstream Ag archive, including reports, frameworks, images, and reference data. Whether you're researching for business development, developing strategy, looking for competitive intelligence, or just a curious professional, it’ll be designed to help you quickly find the insights that matter most.

Data Collaborations to deliver new proprietary data and insights from the market, from the farmer and the channel.

and Expanded Audio Formats

Again, thank you. If you ever have comments, questions, or suggestions, I’d love to hear from you: [email protected]

This week’s audio edition can be found here and covers:

Lavie Bio Sale to ICL (3:05 mark)

Inside Miraterra’s Bet on Soil Intelligence (13:20)

1a. New PDFs Available: Mindware: 33 Mental Models for The Modern Agribusiness Leader

Two weeks ago I released an article breaking down 33 Mental Models I find useful for looking at agribusiness. It has now been published as a PDF guidebook exclusively for Upstream Ag Professional members to print, save or share.

1b. Business Books for Agribusiness Professionals + History of Agriculture Books for Agribusiness Professionals

I’m often asked for book recommendations, particularly on business and agriculture. To make it easier, I’ve compiled a list of 21 business books that have had the greatest impact on me, along with 15 agriculture-focused books that have helped me better understand the events, technologies, people and companies that shaped the industry. Each book listed has an overview and a few takeaways in the document.

To download the Mindware Guidebook, the reading lists, or access any of the other Upstream Ag Professional reports available to you, login to the Report Section of the Professional Hub here.

2. Inside Miraterra’s Bet on Soil Intelligence - Upstream Ag Professional

Key Takeaways

Trace Genomics had challenged unit economics — High fixed costs, low testing frequency, expensive customer acquisition and the education of industry and farmers make it a challenging business to scale.

Miraterra is building a soil testing infrastructure layer — By combining Raman spectroscopy, digital mapping, and Trace’s genomics IP, Miraterra aims to enable labs with scalable, integrated testing and data platforms creating a go-to-market approach that is through the lab instead of to the farmer.

Miraterra, a technology company known for unlocking measurement and insight across soil, plants, and food through breakthroughs in Raman spectroscopy, has acquired the assets of Trace Genomics Inc., including the full suite of Intellectual Property (IP), in-market products, and an analytical lab in Ames, Iowa.

This strategic acquisition combines forces of two leading technology platforms to rapidly advance the field of soil-to-table measurement and insights — supporting agriculture and advancing the resilience and restoration of our global soil health.

There are two notable angles with this news:

A look at the challenges for Trace Genomics

A look at Miraterra, current capabilities and the Acquisition Rationale

Trace Genomics

Trace Genomics was a soil testing company that provided soil microbiome analysis using genomics. Their core offering was a soil test that looked at microbes, pathogens, and other soil indicators, delivering information to farmers and agronomists for making fertility and crop protection decisions. Trace also had a well built customer facing software to look at testing data.

There had been ongoing conversations within the industry about the financial challenges with Trace Genomics. The acquisition price was not disclosed, but we can gauge from founder and CEO of Trace Genomics, Poornima Parameswaran’s Linkedin post that the sale was not optimal— anytime a start-up sells to another one, it’s a sign of challenges.

In March I wrote What the Fall of 23andMe Could Signal for Soil Genomics Companies in Agriculture, but I have previously stated my bullishness for companies like Trace Genomics— from an agronomic perspective, I love the concept.

A deeper understanding of the soil, particularly surrounding biological parameters and fungal pests has upside for agronomic decision making:

However, the question I poorly considered was: “At what cost?”

Economics and Change

Start-up soil testing companies have challenging economics.

With any soil lab business, there are high fixed costs.

Even more when adding the genomics testing assets on top, which means they become a through-put business. Large volumes are required to spread out the high fixed costs.

But getting the volumes up at a manageable customer acquisition cost is difficult, making the unit economics a hurdle.

Consider that even with basic soil testing, the average farmer only tests every 2-3 years, at a cost of just a few dollars an acre (depending on resolution and type of in-field testing). When we look at the cost per acre for a full genomics test (with physical and chemical properties too), it goes well beyond even $10/ac.

A difficult upsell for the average farmer.

Then factor the following quote highlighted by Janette Barnard in Prime Future:

The value of data is the value of the marginal change in actions taken after adding the data to your business process.

There are no doubt improved insights gained from genomics tests like Trace offered.

However, the question becomes, do the insights initiate change above the standard practice? And does that change deliver a return over and above the ancillary cost to acquire it?

For a look at examples of decisions that are made regardless of soil insight, the “Shopify-ication” of agribusiness segments, opportunities for soil labs to improve, capabilities of Miraterra, how Trace Genomics assets complement the business and what it means for who Miraterra serves and how they go-to-market, check out the link in the heading.

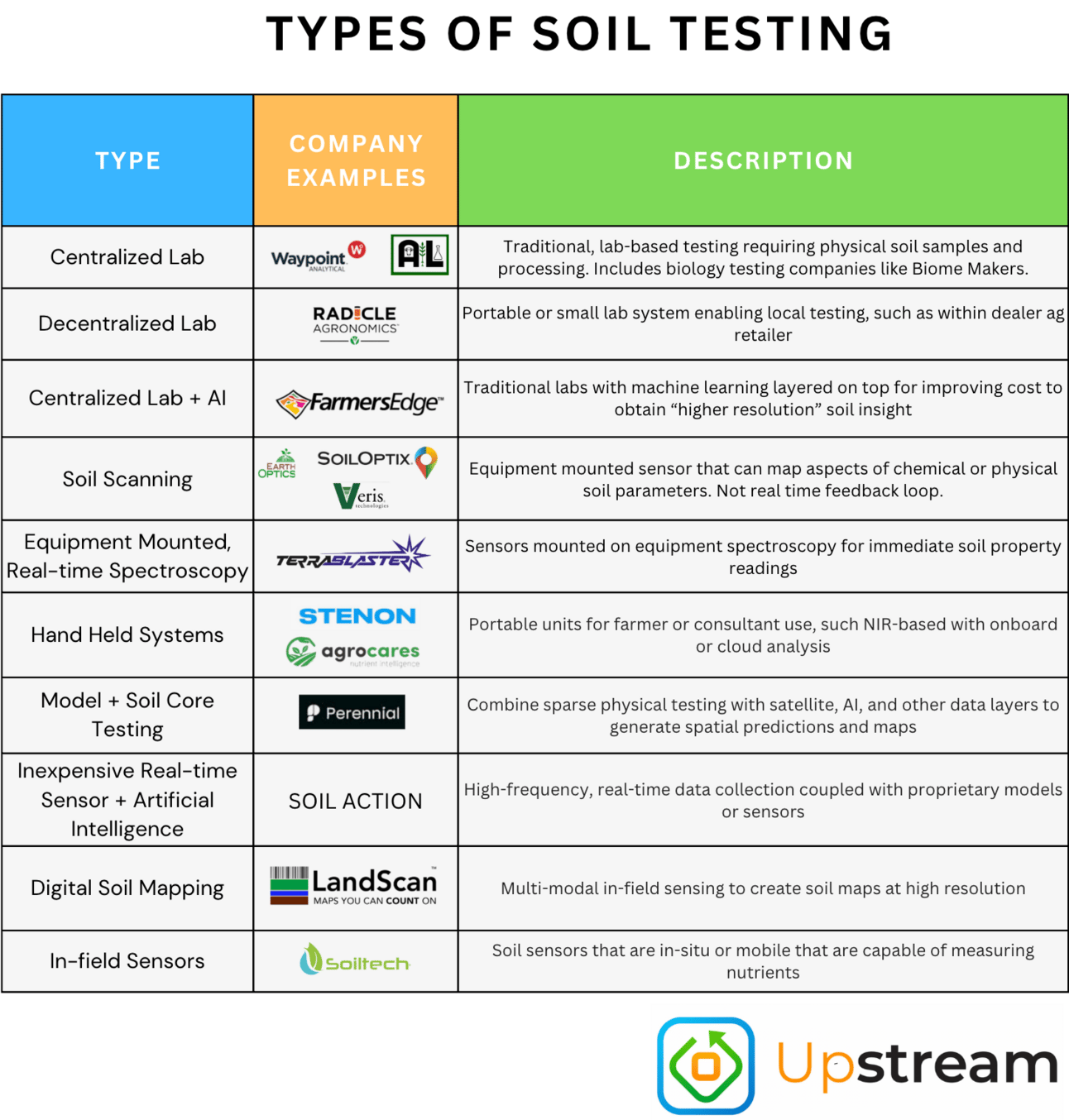

Note — Last week I shared the below image on soil testing. Two comments on it:

I received dozens of messages suggesting companies were missed. For clarity, it was not intended to be exhaustive. If it was intended to be a full landscape map I would have structured it differently. It was intended to look at various approaches to soil testing and then share a couple examples for context.

I received some thoughtful and constructive feedback on the “types.” Specifically around the need for more critical thinking in how the categories were defined. I appreciate the feedback. The comments are right. I did a poor job of making the framework clear, durable, and useful. I appreciate those who took the time to share their perspectives, and I’m working to revisit and refine the categories to improve it.

3. Lavie Bio Sale to ICL Closes - Evogene

Key Takeaways

The acquisition of Lavie Bio by ICL for $18.75 million was announced in April. This week the deal officially closed.

The Lavie price tag was down from its prior implied valuation of over $95 million— suggesting disappointing progress and future prospects despite engagement with multiple of the large crop input businesses like Corteva.

ICL gains a microbial discovery engine and product pipeline to bolster its Growing Solutions segment, aligning with its broader strategy to expand into value-added biologicals and specialty fertilizers, particularly in North and South America.

Pursuant to the definitive agreement originally announced on April 21, 2025, ICL has acquired Lavie Bio’s proprietary Biology Driven Design (BDD) technology platform, microbial bank, pipeline of advanced development programs, and current commercial product offerings. In addition, Lavie Bio’s core personnel will transfer to ICL. Concurrently, Evogene has divested its MicroBoost AI Tech-Engine for Agriculture, a computational engine designed to optimize microbial discovery and development through artificial intelligence, for additional consideration.

ICL completed its acquisition of Lavie Bio and its AI discovery engine for $18.75 million.

The deal completion offers a window into biological innovation and company building: investor returns, pivots, and whether AI-led discovery platforms are delivering on their promise in agriculture.

When the deal was first announced I broke it down in ICL Acquires Lavie Bio and Assets for $18.75 Million: Insights and Analysis from Financials, including some highlights:

Corteva invested the equivalent of ~$27 million through cash and assets in Lavie Bio over several years. Today? Their ~28% stake would net them around $4 million.

ICL gains a microbial discovery engine, 150,000+ strain library, and an internal biostimulant pipeline. During the ICL Q1 earnings call, CEO Elad Aharonson stated:

The acquisition price was a decline in valuation from the >$95 million implied post-money after Corteva’s 2019 investment. The deal however gives ICL access to a proprietary pipeline, a microbial strain library, and a discovery platform enhancing its Growing Solutions segment with internal capabilities.

Related: A CVC Success Story: ICL and Lavie Bio – Setting the Course for a Biologicals Power Hub - ICL Planet

I also read an ICL article on the acquisition last week. The stance is obviously positive on the acquisition, suggesting it is already a CVC success. Maybe it is from the point of the CVC, but it is too early to state whether it is a success for ICL as a whole, particularly given the Agriculture M&A track record (as discussed in M&A in Agriculture: Is the Track Record Any Good?). Nonetheless, it does appear to give ICL assets needed to drive their biostimulant ambitions.

Watching ICL investor commentary over the next 24-36 months surrounding new product development, sales growth of legacy Lavie products (Yalos) and overall sales growth within the Growing Solutions segment of the business will be notable to watch.

Related: Biotrop expands abroad, eyes R$1bn in revenue - Valor

4. Strategy First, AI Second - The Pacesetter Pod

Key Takeaways

Strategy is a system of integrated choices, not a collection of tools or vague aspirations — Using Roger Martin’s Playing to Win framework clarifies that technology (like AI) is an enabler, not a strategy in itself; success comes from aligning capabilities and systems to a clearly defined competitive position.

Digital and AI initiatives must be grounded in a coherent company strategy — Without clear choices around where to play and how to win, standalone "AI strategies" or "innovation strategies" lead to fragmented efforts with limited impact.

In this week’s edition of The Pacesetter Pod my friends Joe Mosher, Patrick Honcoop, and Rhishi Pethe tackled numerous subjects from AI to strategy.

One aspect that stood out to me was their conversation on a need for a holistic company strategy— not a separate "digital strategy" or "AI strategy.”

Often companies emphasize having an "AI strategy" or an "innovation strategy." But without a coherent company strategy, these efforts lack direction and impact.

Having an actual strategy independent of the tools and technology (software, AI) is what enables a company to create customer value, competitive advantage and ultimately shareholder returns.

What is Strategy?

Subscribe to Upstream Ag Professional to read the rest.

Become a paying member of Upstream Ag to get access to this post and other subscriber-only content.

Already a paying subscriber? Sign In.

A professional subscription gets you:

- • Subscriber-only insights and deep analysis plus full archive access

- • Audio edition for consumption flexibility

- • Access to industry reports, the Visualization Hub and search functionality