- Upstream Ag Insights

- Posts

- Upstream Ag Professional - July 28th 2024

Upstream Ag Professional - July 28th 2024

Essential news and analysis for agribusiness leaders.

Welcome to the 52nd Edition of Upstream Ag Professional

Last week, agtech funding announcements totalled $200 million, including releases from InnerPlant, Micropep, Monarch Tractor, Pherosyn, and Agrobiomics, making it a significant week for funding. Additionally, AgFunder announced the close of their Fund IV, which raised over $100 million.

Index:

InnerPlant Raises $30 million Series B, Led by North American Farmers: Highlights and Analysis

The Insight is the Edge: Switch Bioworks

Micropep Raises $29M in Series B Funding and Unveils Krisalix, its Proprietary Discovery Platform: Highlights and Analysis

Monarch Tractor bags record $133m, eyes global expansion for its all-electric, autonomous machines

Agriculture’s Misunderstanding of Data — ‘Battling Big Ag: Safeguarding farmers from data exploitation and US farmer: ‘Theft of my data could deprive me of my competitive advantage’

AGCO to Sell Majority of Grain & Protein Business for $700 Million

54 Questions to Ask about your Biostimulant or Biopesticide

Why Syngenta is Investing in Soil Health with Matt Wallenstein

Upstream Ag LLM Research Tool

Other Interesting Ag Articles (9 this week)

1. InnerPlant Raises $30 million Series B, Led by North American Farmers: Highlights and Analysis - Upstream Ag Professional

Key Takeaways

InnerPlant announced a $30M Series B funding round. The raise is notable for being led by a consortium of North American farmers, underscoring the value placed on InnerPlant’s technology by farmers themselves.

InnerPlant's technology involves genetically engineering plants to emit signals when under stress, detectable via sensors well before visible symptoms appear. This early detection system, combined with their new CropVoice platform, aims to transform agronomic decision-making by providing real-time, actionable data to farmers and agronomists, leading to better crop management and increased farm profitability.

InnerPlant, today announces a $30M Series B funding round led by an alliance of large North American farmers headed by Coutts Agro, an operator and agricultural investor. Joining the round is Systemiq, as well as previous investors Deere & Company and Bison Ventures.

InnerPlant genetically engineers plants to emit distinct optical signals when the plants are under stress, such as when they lack nutrients or are under fungal pressure or attack from insects. The signals are detectable from via sensors, such as satellites or on tractors, and visualize stress as much as three weeks before the human eye can see, giving farmers and early warning system to proactively protect their crops.

Co-founder and CEO of InnerPlant Shely Aronov shared the following on the news:

We’re very proud that this round is being led by the people who best understand what’s needed on the farm and what innovation in agriculture actually looks like….We’ve always put farmers at the center of everything we do and this investment validates that farmer-centric culture and our technology.

It’s not common to see farmers leading a round of this magnitude.

At its most simple, the investment group is a consortium of progressive farmers identifying a technology that can help them be more profitable in their operations that want to see the technology become a tool they can access.

But it’s more sophisticated than that, too.

Matt Coutts, Chief Investment Officer of Coutts Agro leading the raise and InnerPlant board member, shared a Linkedin post highlighting the rationale for investment:

We believe InnerPlant has the last mover advantage by deriving plant stress information directly from the plant, and not a sensor based on secondary information.

Agronomy has been a lot of gut feel and guessing. InnerPlant is changing that.

Traditional sensors are a proxy for what a plant might be experiencing, or could be experiencing— InnerPlant plant sensors can qualify, and quantify, in real-time what a plant needs, or doesn’t need, ultimately aiming to drive better agronomic decisions and more profitable farms.

Matt sharing his investment logic on “why now” is an astute application of Carlotta Perez’s framework that has been emphasized in Upstream before:

We believe precision agriculture is turning from an installation phase, funded by financial capital to the deployment phase led by production capital (leading incumbents and farmers). The pathway to market gets less risky every single day as the company can leverage the “pipes” that have been laid (at a great cost) in digital ag and satellite image capacity in addition to the precision application tools that continue to grow market share.

This comment ties back to a comment Matt made on The Business Breakdown Podcast: John Deere where he stated the following (emphasis mine):

In a lot of industries you may debate when the instalment period ends and deployment period begins. And in agriculture, it's kind of like when Deere says so.

His insight is reinforced by Deere & Co. being a co-investor in this raise along with previously leading InnerPlant’s Series A, and having a three-way partnership agreement between themselves, InnerPlant and crop protection behemoth, Syngenta.

When the John Deere and Syngenta announcement came out I stated the following:

There aren’t many agtech start-ups collaborating in a consortium fashion with not one but two leading agribusinesses. InnerPlant is unique in enabling ecosystem collaborations with industry incumbents.

InnerPlant now partners with or has investment from a notable trio of agribusiness groups:

the largest equipment manufacturer

a top crop protection manufacturer

some of the largest farmers in North America

Not to mention, their partnership with top 3 CropLife 100 retailer, GROWMARK.

For a deeper dive into the importance of data traits vs. resistance traits and what InnerPlant’s new product, CropVoice means for farmers and agribusiness professionals, check out the Upstream Ag Professional link above.

Disclosure: Upstream Ag Ventures Inc. is an investor in InnerPlant.

2. The Insight is the Edge: Switch Bioworks - Upstream Ag Professional

Key Takeaways

Switch Bioworks shares their foundational insights that have been influential in building their technology and business, including the issues with wild-type microbe N transfer to plants and the importance of early season microbe fitness and proliferation to ensure adequate N can be fixed and transferred to the crop.

Switch Bioworks uses genetic engineering to create microbes with a "switching" capability that optimizes their efficacy in nitrogen fixation. This approach helps overcome the challenges of microbial fitness and efficient nitrogen transfer in the soil.

Two weeks ago I shared the article The Insight is the Edge: How Insights Drive Agribusiness Performance.

Insights are fundamental for the success of any business.

An insight is defined as:

the capacity to gain an accurate and deep intuitive understanding of a person or thing.

This can be into a customer, a technology or a market for example.

An insight that is actionable is what differentiates a business. Acting on an insight allows a company to be different and create value, or capture value in unique ways— Switch Bioworks stands out, taking a unique insight surrounding challenges with soil applied microbes and building technology and a business around it— in this instance, specific to maximizing microbe efficacy, specifically starting with precision engineered nitrogen fixing microbes.

Check out the full Upstream Ag Professional article in the link breaking down the nitrogen fixing microbe challenge, Switch Bioworks unique insights into the problem, how they think about delivering the maximum amount of nitrogen via microbes and where their platform might lead next.

3. Micropep Raises $29M in Series B Funding and Unveils Krisalix, its Proprietary Discovery Platform: Highlights and Analysis - Upstream Ag Professional

Key Takeaways

Micropep Technologies raised $29 million in a Series B funding round, bringing their total funding to close to $52 million. This funding will help them accelerate their go-to-market strategy and expand their pipeline of micropeptide active ingredients using their Krisalix platform.

The challenges surrounding micropeptides are immense, however, their ability to potentially deliver new modes of action and molecules, for smaller up front investment at similar efficacy levels as synthetic chemistry make them a segment to watch.

Micropep Technologies (Micropep), the global leader in micropeptide technology, today announced a $29 million Series B funding round along with its proprietary discovery platform, Krisalix. The round was led by Zebra Impact Ventures, and BPI Green Tech Investment. All existing investors, Fall Line Capital, FMC Ventures, Sofinnova Partners, Supernova Invest, and IRDI Capital Investissement also participated, bringing the company’s total funding to more than $51.8 million.

Micropep plans to use the Series B funding to accelerate go-to-market strategy through partnerships, complete the regulatory studies of the first biofungicide molecule, and expand its pipeline of micropeptide active ingredients on the Krisalix™ platform.

Micropep was founded in 2016 as a spin-off of Plant Science Research Laboratory in Toulouse (LRSV) and Toulouse University.

After raising this Series B, Micropep has now raises almost $52 million.

What is a Micropeptide and What does Micropep do?

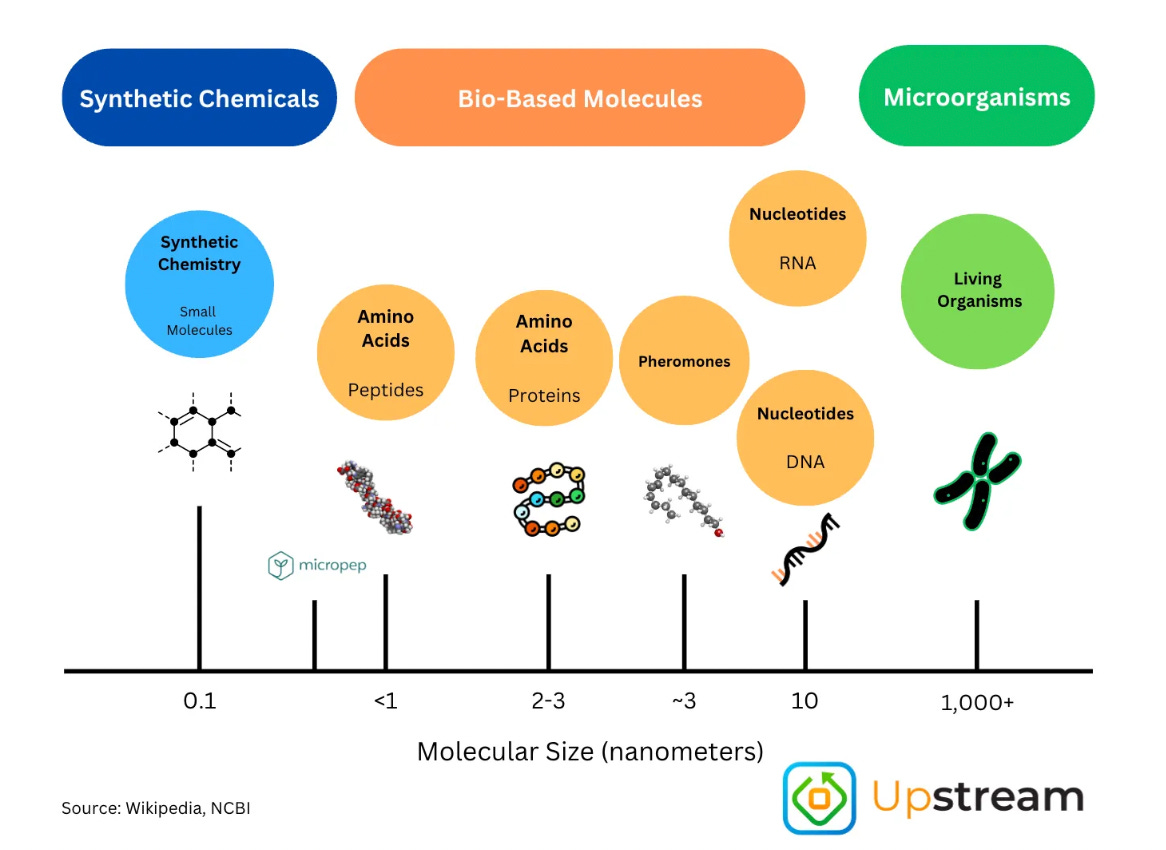

Micropeptides are natural molecules encoded in plant genomes. They are made of about 10 to 30 amino-acids, the natural building blocks of life. There are 20 different natural amino-acids, which give about 10 trillion different combinations possible to make 10 amino-acids long peptides.

What distinguishes Micropep’s peptides from others are their size:

The Micropep platform, Krisalix, leverages computational biology and AI to browse genomes and identify potential micropeptides sequence candidates. The Micropep algorithms help select candidates according to their predefined criteria— the peptides provide control by disrupting specific physiological processes in pests.

Micropeptides have the potential to deliver the efficacy of synthetic chemistry with the environmental footprint of microbials and with less limitation than RNAs, offering better plant penetrability and supply chain/environmental stability.

What makes me excited about peptides is the potential for new modes of action, enabling farmers to better manage resistance, and also the potential lower up-front investment necessary to bring a new mode of action to market (relative to synthetic chemistry).

Micropep is already illustrating potential in the herbicide mode of action realm. In Micropep’s recently granted patent, they talk about some of the weeds targeted:

Finally, it was tested whether cPEPs could decrease the growth of weeds by targeting a Brassicaceae species, Barbarea vulgaris, and it was shown that a mixture of cPEPs targeting corresponding proteins was capable of doing so. To go further, one of the most invasive and problematic weeds, Amaranthus, was selected and cPEPs were designed to target the corresponding proteins…A mixture of these cPEPs was able to decrease plant growth.

Given this, it wouldn’t surprise me to see an Amaranth focused product in the future.

There is potential for peptides as biostimulants as well, as illustrated in numerous journal articles.

Peptide Organizations

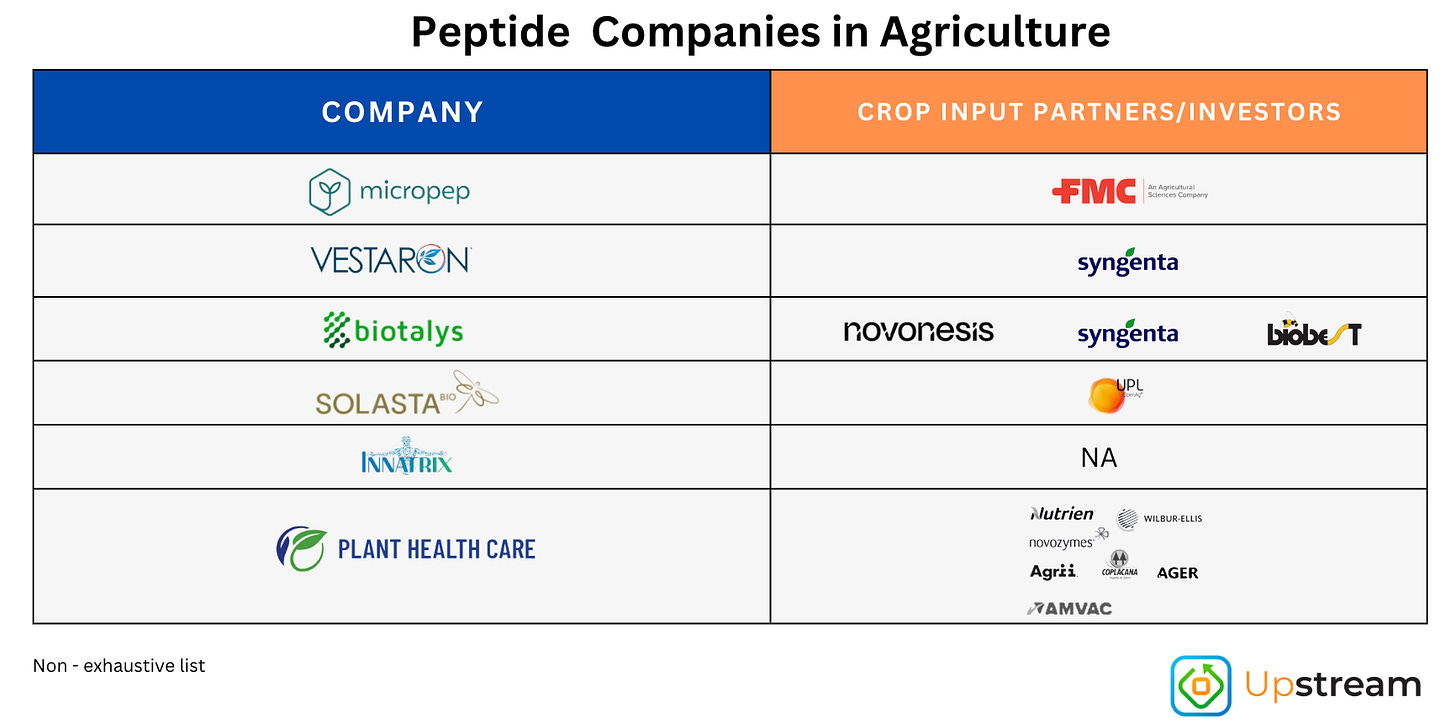

Micropep is not the only peptide based company out there.

Biotalys, a pre-commercial (awaiting registration of first product), but publicly traded company out of Europe currently has a market cap of $106 million USD.

Plant Healthcare Plc is a publicly traded peptide company on the UK stock exchange that is primarily a peptide-product driven company. It was recently announced that they had been acquired by PI Industries, an India-based agchem business for ~$41 million USD. According to their 2023 annual report, PHC had consolidated revenue of $11.2 million with a 60% gross margin in 2023, and $11.7 million of revenue with equivalent margins in 2022.

Other companies include:

For an overview of the challenges with peptides, how they are being worked on, a highlight of Micropep’s pipeline and potential revenue streams, check out the link above.

Related: Yeast-powered RNAi is the future of precision pest management, says Renaissance Bioscience - AgFunder News

4. Monarch Tractor bags record $133m, eyes global expansion for its all-electric, autonomous machines - AgFunder News

Key Takeaways

Monarch Tractor has raised a $133 million Series C round, bringing their toal funding to $220 million.

The post-money valuation likely makes them a less likely acquisition target and shows their effort to become a long-term stand alone business.

California-based Monarch Tractor has raised a $133 million Series C round to support expansion of its all-electric autonomous tractors.

Astanor, which led Monarch’s Series B raise, co-led this fundraising alongside HH-CTBC Partnership, L.P. At One Ventures, PMV, and The Welvaartsfonds also participated.

A $133 million raise is notable for Monarch Tractor, which has tractor products that are focused on orchards and vineyards (a natural starting place for an electric tractor company) and brings its total funding to more than $220 million.

I used to think that CNH Industrial would end up acquiring Monarch Tractor— CNH has a strong presence in the small tractor market plus CNH Industrial has:

a minority investment in Monarch

established a licensing agreement for its modular electrification platform for small tractors

a financing agreement for Monarch customers to purchase their tractors through CNH Capital.

This is a tight tie between otherwise competitors.

However, this recent raise implies a post-money valuation of $500 million - $1 billion+.

That would be a steep price tag for CNH to pay on most time horizons for an entity that states it has sold less than 500 machines in the linked article, and will likely have it’s market focused specifically in that small tractor market for the foreseeable future.

This valuation implies they need to build the next big OEM in agriculture. That means a lot of Monarch Tractors at California wineries, at airports, or some significant strides in battery technology to be more useful across many orchards and high value cropping systems.

Monarch reminds me a bit of a recent “animal health” business that was recently acquired— Invetx.

It is positioned as an animal health business, seemingly meaning it is an “agtech” exit, however, when you read the press release it emphasizes pets and companion animals making it closer to a consumer business than agriculture.

The same could be said about Monarch— the upside for Monarch Tractor might be less in traditional agriculture and more in selling tractors to high net-worth individuals with hobby ranches that are doing less work and pursuing novelty.

This isn’t a knock on Monarch either, just a wonder if the investment in Monarch is really reliant in agriculture upside, or if the upside is in less-agriculture related revenues long term, at least until battery technology improves.

What do you think?

For more, Check out Rhishi Pethe’s breakdown of Monarch Tractor in Software is Feeding the World here.

5. AGCO to Sell Majority of Grain & Protein Business for $700 Million - Market Watch

AGCO announced a deal to sell the majority of its Grain & Protein (eg: grain bins like GSI) business to American Industrial Partners, a Private Equity firm, in an all-cash transaction valued at $700 million. AGCO expects to incur a loss on the sale of the business of ~$450 million.

AGCO said it will use the proceeds from the transaction for debt repayment— in large part to pay down that attributed to their PTx Trimble announcement last year. The rationale for the deal likely has a lot to do with them doubling down on their retrofit and technology strategy with PTx Trimble. The grain asset business was likely viewed as a distraction and not worth pursuing while leaning into technology.

The transaction excludes AGCO's Grain & Protein business in China.

6. ‘Battling Big Ag: Safeguarding farmers from data exploitation and US farmer Anthony Osgood: ‘Theft of my data could deprive me of my competitive advantage’ - Future Farming

Key Takeaways

Farmers and the ag industry often misinterpret where competitive advantage comes from and the value data brings.

Large corporations already possess the means to understand crop production numbers and aggregated farm profitability and can do so for a relatively low cost. Hence, having farmers' data isn't essential for them to be well-informed.

For farmers, data itself isn't the competitive advantage; it's the strategic use of specific data to optimize operations, reduce costs, increase production, and secure better cost positions and structures within their operations that competitive advantage comes from.

There were two article in Future Farming talking about data risk. Both these articles reinforced to me the ag industry still grossly misunderstands data and where competitive advantage comes from.

Quote #1:

Farmers often don’t know how their data is used, allowing large corporations to exploit it for profit. For instance, if a company learns from farmers’ data that a region has a high crop yield, it might manipulate market prices downward. This can harm farmers who unknowingly consent to data collection without fully understanding its implications.

There is of course risk of big companies behaving unethically. I do not think the above is an example of it, though.

Matthew Pryor, Partner at Tenacious Ventures wrote the following in The Factory Has No Roof:

Anyone who wants to know what is happening on a farm already can — they don’t need farmers to generate or provide it.

It is increasingly the case that farm activity is observable and basic knowledge can be obtained at low cost and in real-time for most agricultural production.

In aggregate, large companies know how much grain is grown. They know how profitable a region is. They know how to price products. Having farmers data is unnecessary for them to be that well informed— this gets forgotten much too often.

In the specific, there could be a risk. For example, if pricing was ever to get down to a specific farmer direct from an input manufacturer (eg: crop protection providers adjusting pricing to singular individuals), that enters an area many might not be comfortable with. However, the deployment of this in North America is unlikely, at least today (channel dynamics).

Quote #2

The biggest threat is theft of data. This is the most sensitive data of my operation. Theft could deprive me of my competitive advantage. Ag in the United States is an incredibly competitive market now. All your neighbours would not bat an eye to take the land you are leasing for their own. Especially if the big ABCD’s (ADM, Bunge, Cargill, Dreyfus) get a hold of it.

There has been so much talk that “data is valuable” that many blindly believe it without taking a step back to ask why data can be valuable.

Data is not a competitive advantage in farming.

Using that data to structure a farm operation in a way that enables the business to have a lower cost to produce, identify novel assets to invest in or vertical integration, accesses capital at a lower cost, optimize production or find a grain premium is what makes that data valuable to the farm. That is where competitive advantage comes from in farming.

The best farmers I know could give their farm data away to their neighbors because they know they have built an advantage through investment and superior cost structure.

There is a risk someone can come in an “take” their rented land by bidding higher for it, but if a farmer has a superior cost structure, logistical infrastructure etc, then I am optimistic they are positioned better anyways.

Related: Safeguarding Agricultural Data: Ensuring Trust and Transparency in Digital Ag - Patrick Honcoop Linkedin

7. 54 Questions to Ask about your Biostimulant or Biopesticide - Foresight Agronomics

Layne Harris at Foresight Agronomics constantly shares insightful content relevant to the bio space. She brings a deep scientific perspective that also delivers practical insight for any agribusiness professional.

This week she shared a list of 54 questions to better understand the products and molecules that a company is promoting— all very well thought out.

I think her list is highly useful and pairs well with other business and commercial questions, like the ones I highlighted previously in Upstream.

Related: Understanding Differences in Defining Biologicals: A First Step to Global Product Launches - Agrithority

8. Why Syngenta is Investing in Soil Health with Matt Wallenstein - The Future of Agriculture

Key Takeaways

The importance of soil in crop production is increasingly recognized, with Syngenta emphasizing soil health by hiring Matt Wallenstein as Chief Soil Scientist in 2022.

Syngenta is building its core competency around soil, combining it with expertise in crop protection, R&D, and leaning into innovative partnerships like Interra Scan and LivinGro. This focus aims to not only support current product segments, but leads into other product and service offerings.

This podcast is a good listen for those wanting to learn more about soil, along with how Syngenta thinks about soil in relation to their business. Matt Wallenstein is an incredibly articulate and insightful individual on soils, which makes the podcast worth a listen.

I have continually emphasized my view on the importance of starting with the soil. Soil drives everything in crop production.

Yet, until recently, most crop protection and seed companies have had virtually no emphasis or deep understanding of soil dynamics— whether, physical, chemical or biological.

Today, soil is being emphasized, particularly by an entity like Syngenta that hired Matt as its Chief Soil Scientist in 2022.

I have talked about crop protection companies like Syngenta not having soil knowledge as a core competency (specifically in North America) and the opportunity in this whether in biostimulants, crop protection, seed, fertilizer and more to differentiate Syngenta long term.

A core competency is a defining capability or advantage that distinguishes an enterprise from its competitors. It's the combination of pooled knowledge and technical capacities that allow a business to be a leader. Core competencies involve the harmonization of complex streams of technology and work activity, providing the company with a unique and sustainable edge. These competencies are not easily replicated by competitors, as they encompass a unique blend of skills, technologies, and processes that create unique value for customers.

I believe effective product development and the ability to effectively sell those products in the market stems from core competency.

Syngenta has world class knowledge in many things, like crop protection R&D, formulation, plant pathology, marketing and more — this enables them to be a leader in segments like synthetic Seed Treatment, for example.

Having a team like Matt’s soil scientist team is a great catalyst to ensure that Syngenta has a core competency building around soil. This team augments the acquisition of a company like Valagro, but it’s also through unique partnerships and product offerings— such as Interra Scan in Europe, LivinGro in LatAm and MAP in China. The “doing” aspect is one sure way to gain experience and capabilities. Notably, there are no soil focused offerings in North America, which probably has more to do with channel dynamics than anything else.

Increasing Syngenta’s core competency in soil should enable them to not expand their product offerings, but expand their effectiveness in delivering useful insights about their core products today, like seed and crop protection products.

Related: How Syngenta is Thinking About AI with Feroz Sheikh - Tenacious Ventures

Access the Upstream Ag Professional member-exclusive search and LLM functionality:

Your access code is B50F96609C83B2D5

*Thanks to visorPRO for working with me to develop this functionality

Non Ag Article

Strategy & Sustained Innovation - Roger Martin

Don’t work on creating an innovation. Work on being an innovative company. If your goal is to create an innovation, if you succeed in the task, you will likely rest on your laurels exploiting your singular innovation. If your goal is to be an innovative company, when you create an innovation, you will immediately ask: OK, what innovation is next?

Other Interesting Ag Articles

Better Isn’t Good Enough - The Daily Scoop

Patent cliffs and "value" innovation - Software is Feeding the World

PheroSyn secures funding from Tall Grass Ventures to advance sustainable pest management solutions - AgReads

John Deere Speaks Publicly For the First Time About Layoffs, New Challenges in the Ag Economy - The Daily Scoop

Could robot weedkillers replace the need for pesticides? - The Guardian

AgFunder VC closes Fund IV oversubscribed on $102m, reveals deep tech portfolio focus - AgFunder News