- Upstream Ag Insights

- Posts

- Upstream Ag Professional - November 2nd 2025

Upstream Ag Professional - November 2nd 2025

Essential news and analysis for agribusiness leaders.

Welcome to the 117th edition of Upstream Ag Professional

Index

The Four Forces Reshaping the Crop Protection Industry and What Comes Next

What Agribusiness Professionals Can Learn from the State of AI In Business Report MIT

Q3 2025 Earnings Results: BASF, FMC, Syngenta, AGCO, ADAMA + Marubeni/Helena Investor Day Materials

Gowan and Geco Strategic Weed Management Partner

HGS BioScience, a Leading Bionutritional Platform, on its Acquisition of NutriAg and Debt Financing to Support the Transaction

Carbon Robotics founder Paul Mikesell on agtech: ‘Be careful how you talk about it’

M&A Science: When Integration Beats Roll-Ups with Tim Hall

Other Interesting Ag Articles (10 this week)

Thank you for being an Upstream Ag Professional member!

This week’s audio edition can be found here and covers the following:

The Four Forces Reshaping the Crop Protection Industry and What Comes Next

FMC Q3 2025 Results

1. The Four Forces Reshaping the Crop Protection Industry and What Comes Next - Upstream Ag Professional

Key Takeaways

The discovery-driven model built on patented chemistry and distribution control is structurally breaking down. Generic manufacturing, regulatory pressure, and slower innovation cycles have eroded barriers that once protected incumbents. Precision spraying could redefine where differentiation and margin sit in the system.

Crop protection is following the pharma and tobacco playbooks: outsourcing R&D, acquiring innovation externally, reframing narratives and rationalizing costs. The focus is moving from discovery to integration.

The global synthetic crop protection industry has been changing for years.

While the question has been whether it is structural or cyclical, the structural changes are hard to ignore.

The traditional model has been anchored in discovery, patented products and broad distribution influence and control, but that is being eroded from multiple sides.

We are seeing this in action with the news from the Corteva and splitting out their business units, the challenges for FMC and navigating the new landscape (link to Q3 Results) along with the Bayer challenges broadly.

There is no question farmers will continue to demand efficacious and easy-to-use crop protection products, which means new molecules will still drive revenue and margin for the traditional players ,like Syngenta, Corteva and Bayer, however, the relative number of them coming to market, the alternative tools available to farmers and the competition from generics and “tier 2 and 3” companies will change the ability for large innovation companies to maintain the same level of overhead, R&D investment and business structure as what they had in 1995, 2005 or 2015.

There are four macro dynamics that are influencing that structural shift (in no particular order).

1. Expansion of Generic Manufacturing

Manufacturing capacity in India and China has scaled rapidly, lowering production costs while improving product quality.

These overseas firms possess the scale, formulation sophistication, integration downstream and upstream and contacts to compete globally, and arguably, the infrastructure is over built which means these companies are producing large amounts to spread out fixed costs and then move product to market. There are market dynamics that can slow this down, such as shortages or price spikes in intermediates, but the data suggests there are significant changes that will keep the big five companies challenges in the years to come.

Consider information from The Generics Revolution and the New Economic Geography of the Global Pesticide Industry:

Formulated product exports have shifted from primarily North America and Europe to China, whose export share grew from 15% of global volume in 2003 to 46% in 2023.

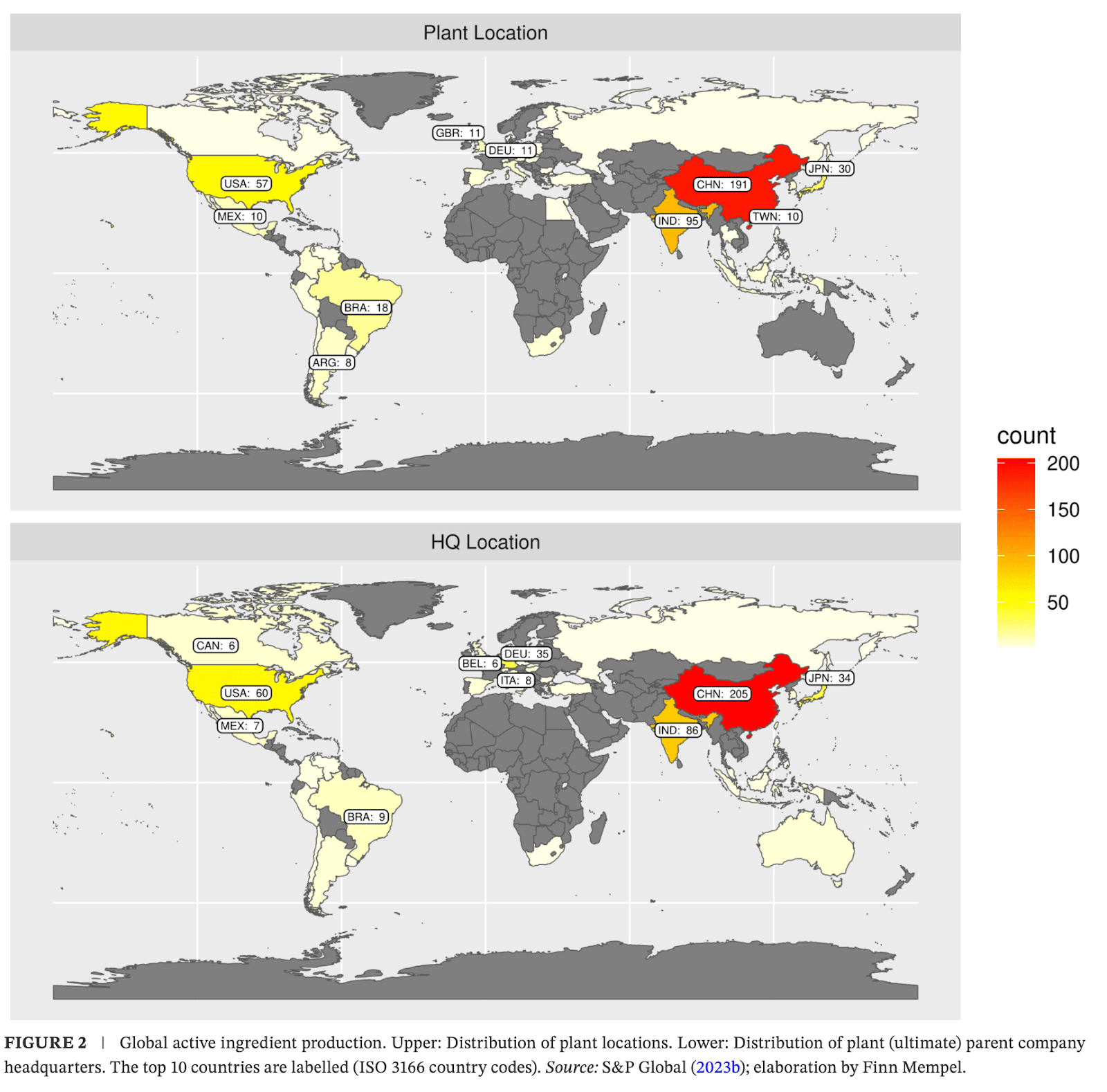

There are 527 individual plants that produce active ingredients across all pesticides with China having 191 plants (36%) and India having 95 (18%) as the largest players, making up 54% of the total plant number globally.

29 of the top 50 companies in terms of sales value were located in mainland China, accounting for 42% of total sales.

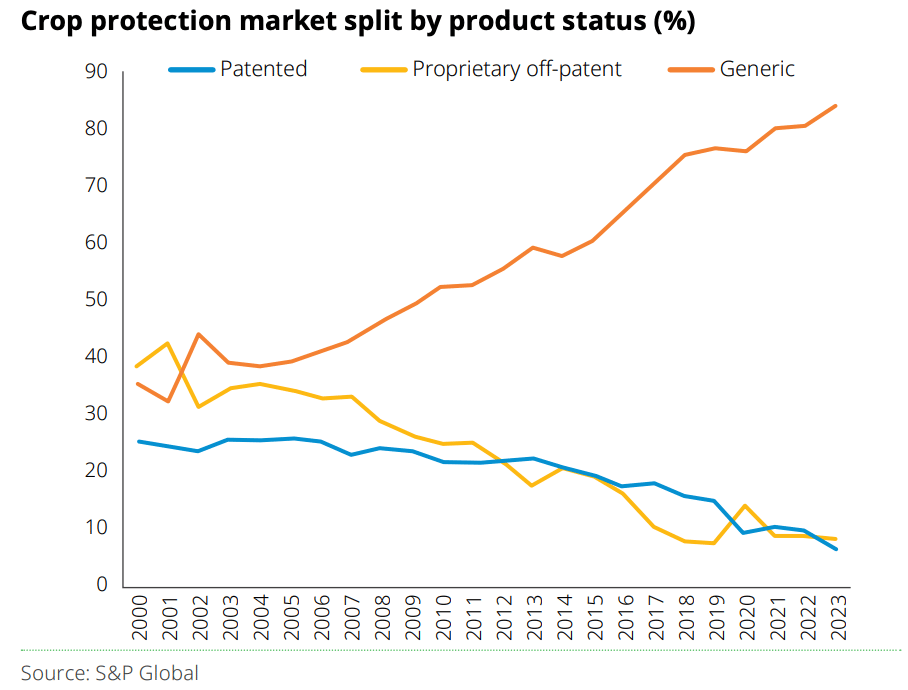

In 2000, generics were less than 33% of the market globally. As of 2023, they accounted for over 80% of sales.

Note: Global data. This likely varies by region.

Given the proliferation of capacity, it has increased the ability for a distributor to have connections and relationships into China or India, making it easier for ag retailers, particularly as they have consolidated, to connect directly with manufacturers overseas. More on this later.

2. Patent Cliff and Innovation Stagnation

Many of the blockbuster molecules from the 1990s and 2000s have lost protection, while the pipeline of new active ingredients has dwindled:

Subscribe to Upstream Ag Professional to read the rest.

Become a paying member of Upstream Ag to get access to this post and other subscriber-only content.

Already a paying subscriber? Sign In.

A professional subscription gets you:

- • Subscriber-only insights and deep analysis plus full archive access

- • Audio edition for consumption flexibility

- • Access to industry reports, the Visualization Hub and search functionality